Tax deductible work boots and uniforms

she wear - 9th June 2022

June 30th is nearly upon us and it's nearly tax time. The end of financial year is a perfect time to update your work boots, work uniforms, hi vis workwear, or other work shoes and uniforms that you need for your job. Many of these items are tax deductible and claimable on your tax return.

The general rule of thumb is that if you have a particular uniform requirement, need a specific type of boot or workwear for your role (such as safety toe boots, or hi vis workwear), you can claim this back on tax. Because she wear offers women's safety boots, work shoes and workwear often needed as part of an official uniform or industry requirement, many of our items are tax deductible.

Because we are shoe wizards and not tax accountants, we also encourage you to check with your local accountant or tax organisation (see below for advice on how to do this).

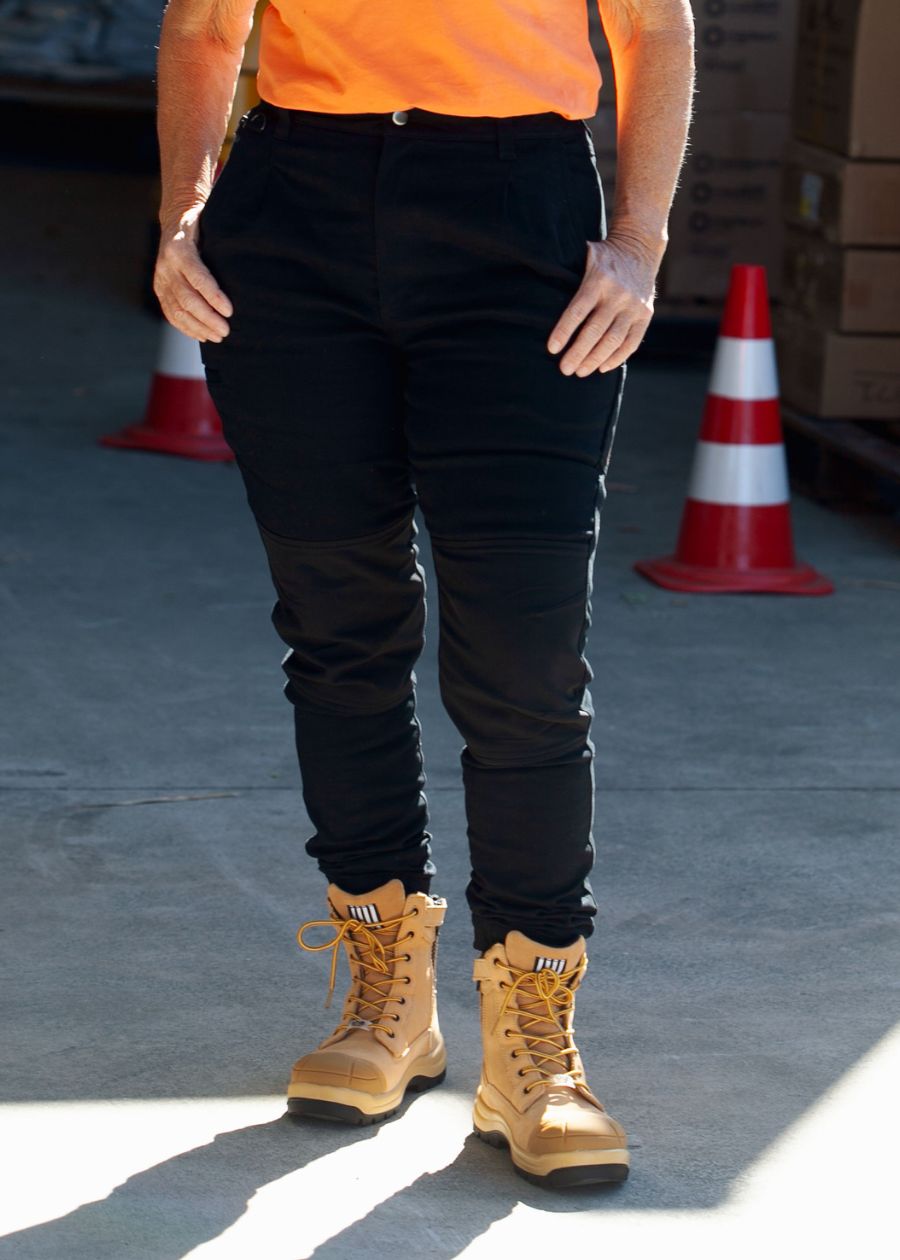

Top work shoes and workwear items you could claim on tax

We get a lot of she wear customers that purchase work shoes, safety boots and workwear for use during their job. If you are not sure what to buy and claim on tax, we've done the hard work for you and put together a list of 10 she wear products that may be claimable on tax.

How to check if an item is tax deductible

She wear are shoe wizards that make specialised work shoes and safety boots for women in industries from construction, building and transport through to farming, gardening, hospitality, nursing and retail. Whilst we can give an indication of what might be tax deductible for our customers, we are (cough....) not boring tax accountants haha. We therefore recommend that you obtain formal advice on what items can be claimed on tax as part of your purchase. Here are a couple of ideas for who to get in touch with:

Your Accountant. Your accountant is a great place to start. More often than not, accountants are where most of us go to get our tax returns completed, and are a great point of contact to check if your work boots and uniforms can be added to your tax return as a claimable deduction. Make sure you keep your receipt as they will often ask for that as part of the claim.

Tax specialist. If you don't have a regular accountant, there are many businesses that operate as tax specialists. These business are another good place to find out if your shoes and workwear are deductible. A simple google search for "tax specialist near me" should identify someone suitable in your area.

Local tax organisation. Most countries have a tax specific organisation that you can visit for advice. For example if you are in Australia or New Zealand, this is the Australian Taxation Office (ATO), or the Inland Revenue Department (IRD) respectively. If you are in the United States of America (USA), the Internal Revenue Service (IRS) is the department to get in touch with, while the United Kingdom (UK) is the HM Revenue & Customs.